Get your UDYAM registration consultancy now @ INR 1990 only

Udyam Registration or MSME Registration is the new process for registering MSME (micro, small and medium enterprises) launched by the Ministry of Micro, Small & Medium Enterprises on July 1, 2020. The Ministry had also revised the definition of MSMEs from the same date.

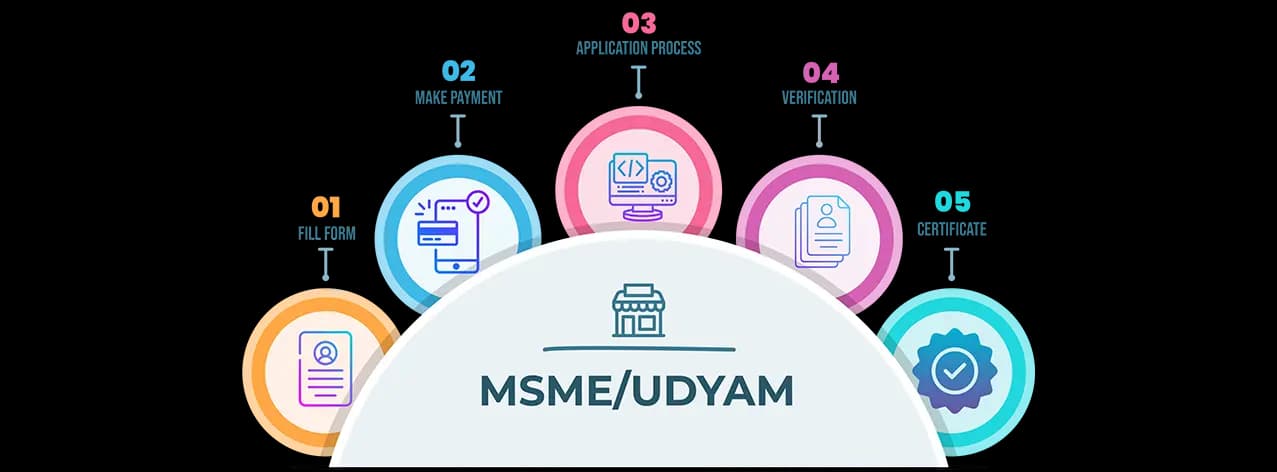

An enterprise for this process is known as Udyam, and its Registration Process is known as Udyam Registration. A permanent registration number along with a recognition certificate will be issued after Registration.

Registration Procedure