One of the smartest ways to make your business stronger and more secure is to get MSME Registration. Still, many entrepreneurs struggle with the process because they don’t know the benefits, required documents, or the correct steps to follow.

That’s why we created this complete guide to help you. Also, we provide an end-to-end process of MSME Registration, which helps you to avoid mistakes and long paperwork so you can begin your journey towards government recognition, better financial opportunities, and stronger growth.

What is MSME Registration

The government introduced MSME Registration in 2006, and later updated it to Udyam Registration from 2016. When you register your business as an MSME, the government gives you a special identification number called Udyam Registration Number (URN) and a digital certificate. This msme registration certificate proves that your business is a micro, small, or medium enterprise.

Getting MSME Registration tells the government that your business is small but important, and you need support to grow. Once you have this certificate, you can have access to many helpful benefits like easy loans, lower interest rates, government subsidies, tax relaxations, and protection from late payment. These benefits are designed to make small businesses stronger and more stable. MSME Registration gives your business a special identity and advantages that make your business easier to grow. It helps you build trust with banks, customers, and suppliers because it shows that your business is legally recognised. MSME Registration acts as a support system from the government. It gives your business the backing, protection, and opportunities it needs to move forward confidently.

Benefits of MSME Registration (Why Every Small Business Should Apply)

1. Low-interest loans and faster approvals

- Banks and financial institutions prefer MSMEs because they are recognised and protected by the government. When your business is registered:

- You get loans at lower interest rates compared to non-MSME businesses.

- Banks process your application faster because your MSME Certificate acts as proof of business credibility.

- You receive access to special MSME loan schemes like Mudra Loans, CGTMSE Loans, and MSME Credit Guarantee loans.

- Your business also becomes validated for priority sector loaning, meaning banks must fulfil a percentage of their loan targets through MSMEs, which increases your chances of approval.

2. Protection against delayed payments

Delayed payments from buyers and clients are one of the biggest reasons small businesses face financial difficulties. How MSME registration helps:

- Buyers must make payments within 45 days, as per MSME law.

- If payment is delayed, buyers are legally required to pay compound interest (3 times the bank rate) to MSME.

- MSMEs can file complaints through the MSME Development Act, 2006 gives you strong authority in case of disagreement.

3. Eligibility for multiple subsidies

The government provides a wide range of subsidies to reduce operational costs for MSMEs:

- Technology upgrade subsidy to modernize tools, systems, and machinery

- Tool room training subsidy for employee skill development.

- Industrial promotion subsidy for purchasing new equipment.

- Capital investment subsidy for purchasing new equipment.

- Export promotion subsidy to help MSMEs enter global markets.

- Export promotion subsidy for branding, packaging, and exhibition participation.

- Patent registration subsidy to support innovation

4. Priority in government tenders

Government departments often reserve a fixed percentage of their supplies for MSMEs. With MSME registration:

- You get relaxation in tender fee, reducing your bidding cost.

- You get an exemption from the Earnest Money deposit (EMD), which helps you save capital.

- Your application receives priority during checking, increasing your chances of selection.

- MSMEs can have reserved quotas in various sectors like manufacturing, construction, services, and supply contracts.

- You can participate in schemes like MSME Sambandh, which connects MSMEs to government projects.

5. Collateral-free loans under the credit guarantee scheme

Under the credit guarantee trust for micro and small enterprises (CGTMSE):

- MSMEs can get loans without giving collateral or security.

- Loan coverage limits go up to ₹5 crore under certain conditions.

- Banks receive assurance from the government, reducing the risk of default.

- This scheme supports both new start-ups and existing businesses.

6. ISO Certification reimbursements

To promote quality improvement and global standards, the government reimburses the cost of an ISO certificate for MSMEs:

- Eligible expenses include ISO certification fee, consultant fees, and testing equipment charges.

- This helps your business gain customer trust and meet export requirements

- ISO certification also improves product branding and recognition

7. Easier access to licenses and registrations:

Many government departments require MSME proof for issuing licenses, permits, and approvals. With your msme registration certificate:

- You receive quicker approvals for licenses like pollution, electricity, GST, FSSAI, and trade licenses.

- You need to submit fewer documents, making the process smoother.

- Authorities trust businesses with MSME certification because they are verified.

- You can apply for industrial land, shed allocation, and industrial park benefits easily.

8. Increase in business credibility and branding

MSME registration adds professional credibility to your business. It helps you:

- Build trust with banks while applying for loans

- Receive better support from suppliers and manufacturers.

- Improve your image in the eyes of buyers and corporate clients

- Show customers that your business is government-recognised and compliant

- Stand out from unregistered or informal business.

9. Support for export and international business

MSME receive strong support from the government to enter export markets:

- Lower fees for export registrations and documentation

- Access to export promotion councils, buyers-seller meets, and global trade fairs

- Subsidies for international advertising and product promotion

- Assistance under schemes such as MEIS, EOUs, and export credit insurance.

10. Reduced electricity bills

Several states offer electricity bill concessions exclusively for MSMEs. These benefits may include:

- Lower electricity tariff (duty or customs duty) rates for industrial units

- Discounts on monthly electricity bills based on business category

- No charges on load extension charges when increasing production capacity

- Subsidies for installing solar panels or using energy-efficient equipment.

Eligibility Criteria for MSME Registration

MSME Micro, Small, and Medium Enterprises, classification in India depends on two main financial metrics:

- Investment in plant and machinery or equipment

- Annual turnover (revenue)

The old MSME criteria (pre-2025) had lower thresholds for investment and turnover. From April 1, 2025, the government has significantly raised these limits; investment limits are 2.5x higher, and turnover limits are doubled. These changes enable MSME classification for larger, growing businesses, ensuring continued access to benefits such as credit, subsidies, and legal protections. For business owners, this is a great opportunity, but it’s important to carefully check your investment and revenue numbers according to the new rules.

Pre-Revised (Old) Criteria

| Category | Investment Limit | Turnover Limit |

| Micro | Up to ₹ 1 crore | Up to ₹ 5 crore |

| Small | Up to ₹ 10 crore | Up to ₹ 50 crore |

| Medium | Up to ₹ 50 crore | Up to ₹ 250 crore |

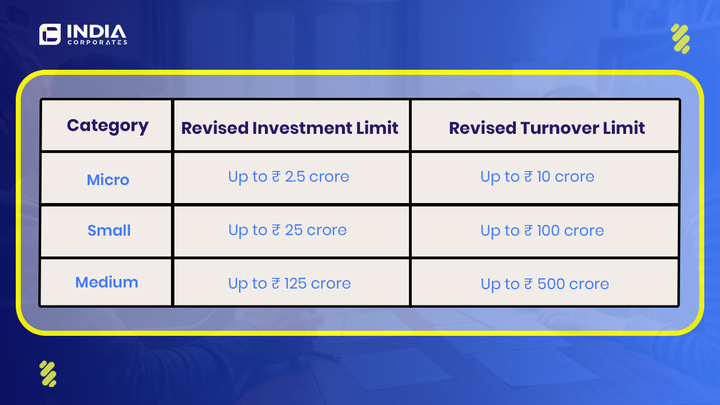

New (2025) Criteria: Major Changes Effective from April 1, 2025

In the Union Budget 2025, the government announced significant changes to these eligibility limits. These changes became applicable from 1 April 2025.

Step-by-step process of MSME Registration

Many people face issues with OTP errors, incorrect category selection, or mismatched details. To avoid these problems, India Corporate manages the entire process for you

Step 1: Visit our MSME Registration page

Step 2: Fill out our form and apply for registration

Step 3: Share required documents

Step 4: Our expert will handle all further processes

Step 5: You will receive your MSME registration certificate

Documents Required for MSME Registration

The msme registration online requires very few documents. Most details are auto-verified by government systems.

- Aadhaar Number of the business owner

- Pan Card

- Business name and business details

- Bank account number & IFSC code

- Investment in machinery/equipment

- Annual turnover (as per GST data)

How to check MSME Registration status

Step 1: Visit the official Udyam registration portal

Step 2: Click on Verify Udyam registration or check status

Step 3: Enter your Udyam registration number (URN)

Step 4: Click on validate/verify

Step 5: Check your MSME status on screen

If the number is valid, the portal will display your MSME details. If your registration is active, it means your MSME status is valid.

If the number is not found, it may mean:

- The registration is still in process

- Udyam number is incorrect

- Mobile number or Aadhar was not verified during registration

Conclusion

MSME registration offers a wide range of benefits that help your business grow smoothly, reduce costs, and secure financial support. Whether you are running a manufacturing unit, a service company, a startup, or a home-based business, MSME registration can greatly improve your business opportunities.

But handling registration alone can be confusing and time-consuming. That’s why our MSME registration online service is designed to give you a simple and reliable solution. We take care of the entire process so you can focus on growing your business. India Corporate is here to help you get your MSME registration certificate easily and without any confusion or delays.

We are here to help you get your MSME registration certificate without stress, confusion, or any delays.

No comments yet