If you’re starting a business in India, one of the first things you come across is the NIC code. The NIC (National Industrial Classification Code) is your business’s unique ID card that tells the government exactly what you do. NIC code is like a secret key that unlocks government schemes, loans and legal registration designed for your business.

While applying for Udyam registration, Company registration, or other government certifications, choosing the right NIC is important because it classifies the type of economic activity of the business. Let’s understand the importance of the NIC code and how to select the correct NIC using the India Corporate NIC code finder free tool.

Understanding the NIC code

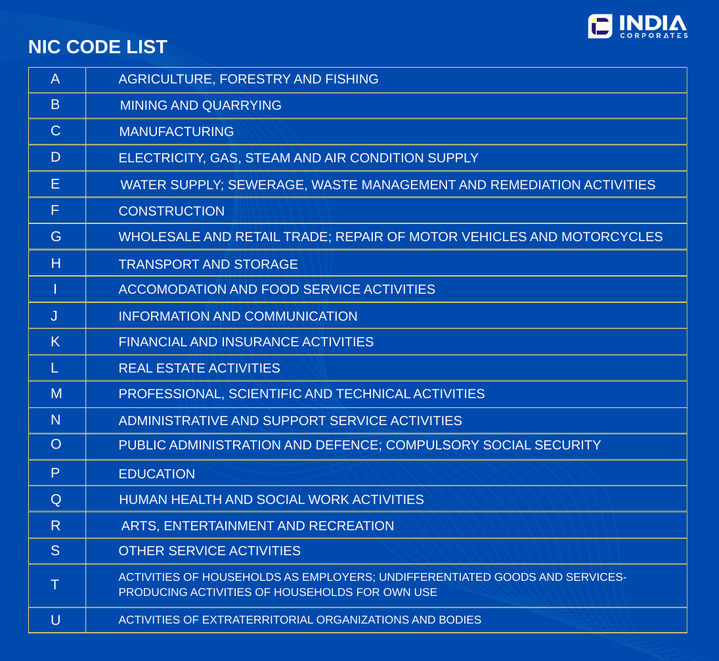

NIC code (National Industrial Classification Code) is a number given to different types of business activities based on what they do and how they work. This NIC code list creates an organised system to group industries and businesses properly. It has a few digits, and each digit shows a different level of classification. The first digit points to large industry categories, and other digits highlight more detailed sub-sectors and specific activities.

Structure and format:

- Section: Represented by alphabet (A to U)

E.g. section A: Agriculture, forestry and fishing - Division: Two-digit numeric code within each section

E.g. 10: Manufacture of food products - Group: Three-digit numeric code under each division

E.g 105 Manufacture of dairy products - Class: Four-digit numeric code under each group

- Sub-class: Five-digit numeric code for specific business activity

Characteristics of the NIC code

- Organised structure: The NIC code has a step-by-step format with 2 to 5 digits, which helps classify business activities from broad to very specific

- Based on business activity: It groups businesses according to what they mainly do, such as manufacturing, trading or providing services.

- Official and government-approved: The list is created and updated by the Ministry of Statistics and Programme Implementation (MoSPI), making it an official standard for all industries.

- Important for legal work: The code is required for many registrations like Udyam (MSME), GST, company formation and government processes.

Same system used everywhere: One uniform NIC list is used across the country for all sectors, making sure every business is classified in a consistent way.

Importance of NIC code for business

- Needed for major business registrations: Without a NIC code, these registrations cannot be completed. You must provide the NIC code during:

– GST registration

– Udyam (MSME) registration

– Company registration

– Import-export code (IEC) - Helps the Government identify your business activity: The code tells authorities exactly what your business does. This makes verification faster and ensures your company is placed in the correct industry category.

- Required for availing of Government schemes: Many benefits, subsidies and MSME schemes depend on your business type. The right NIC code helps you qualify for schemes meant for your industry.

- Make data reporting and analysis easy: NIC codes help the government study industry growth, economic trends and business performance. This allows better planning and policymaking.

- Avoids compliance issues: A correct NIC code ensures business information is accurate in official records. This reduces the chances of rejections, delays and errors during audits.

- Useful for multi-activity businesses: If your business has more than one activity, the NIC helps classify each part clearly.

Where is the NIC code used?

- Company registration

When registering a company, LLP or partnership with the Ministry of Corporate Affairs (MCA), the National Industrial Classification helps classify your primary business activity. This makes sure that your business is officially recognised in the correct industry category. - Udyam (MSME) Registration

NIC code for MSME is mandatory during Udyam Registration. It defines your business activity, which helps determine eligibility for government schemes, subsidies and priority sector benefits. - GST Registration

NIC codes are used during GST registration to identify types of business activity and classify goods and services accurately. This classification also helps in tax filings and compliance. - Import-Export code (IEC)

Businesses applying for IEC need the correct National Industrial Classification code to specify the industry sector for import-export purposes. This makes proper categorisation and reporting in trade statistics. - EPF & ESI Registration

The Employees’ Provident Fund (EPF) and Employees’ State Insurance (ESI) departments use NIC codes to understand the nature of your business. This helps determine contribution rates, compliance requirements and applicable labour laws. - Government schemes, Subsidies and loans

Many government schemes, incentives and bank loans for businesses are industry-specific. NIC codes help authorities identify eligible businesses for schemes like MSME subsidies, Technology adoption grants, startup and innovation programs - Statistical reporting & economic surveys

NIC codes are used in Industry surveys, census of manufacturing and services, and economic growth analysis. This enables policymakers to make informed decisions and develop sector-specific policies. - Licensing and Certification

Some licenses and approvals, like Pollution control certificates, food licenses, trade and industry-specific permits, require a NIC code to determine which regulations apply to your business. - Research and market analysis

NIC codes also help researchers, analysts and market experts track trends for specific industries, understand sector performance, and study employment patterns. - Multi-activity businesses

For businesses engaged in multiple activities, the code allows classification of primary and secondary business activities, which enables proper reporting and compliance.

The Right Way to Choose Your NIC Code: Do’s & Don’ts

1. Identify your primary business activity

Start by determining what your business mainly does

- What product or service generates most of your revenue?

- Is your business manufacturing, trading or service-oriented?

2. Refer to the NIC code list

India follows the NIC 2008 classification system, which organises businesses hierarchically:

- Section (A-U): broad industry sector

- Division (2 digits): specific segment of sector

- Group (3 digits): Narrower category under division

- Class (4 digits): Detailed activity within group

- Sub-class (5 digits): Most specific activity

Use our free tool, the NIC code finder, to search codes

3. Match closely with your business activity

Look for code that best reflects what your business actually does on a day-to-day basis. Accuracy is more important than picking popular code.

4. Consider multiple activities

If your business operates in more than one sector, choose the primary NIC code for the main activity. Add secondary codes for other activities

5. Review and update if necessary

Many government portals allow you to update your National Industrial Classification if your business activity changes. Keep your code updated to remain eligible for schemes and compliance requirements.

Do’s

- Choose code that matches your main business activity, pick one that covers the majority of your revenue.

- Use extra NIC codes if your business has more than one activity (like manufacturing and selling)

- Always check the NIC code list and select the correct NIC that fits your work correctly.

- Use the same code for GST, Udyam, bank KYC and other registrations for consistency

- Update your code if your business activity changes later

Don’ts

- Don’t choose code based on what you plan to do; select one that matches what you do right now.

- Don’t select random or broad code just because it looks close; it can cause registration problems

- Don’t ship compliance checks; using the wrong NIC code can lead to issues with GST, MSME or licenses

- Don’t mix up manufacturing and service codes if you are only doing one of them

- Don’t guess code; always confirm it using the NIC list.

Example 1:

A Small IT Service Company

Business name: Invocreto

Business activity: Invoicing software development & Business Solutions.

Correct NIC code: 6201/6202

Invocreto is an IT service company that mainly works on developing software and tools that help businesses with invoicing and automation. Their main work is writing code, building applications and offering IT-related services, so NIC code 6201 ( software development services) and 6202 (IT consultancy and support) are the right match

Why is this NIC code important?

- Company registration: When they register a company with MCA, this code tells the government that the business belongs to the IT and software sector

- Investor & bank clarity: if Invocreto wants funding or loans, banks and investors can easily understand the nature of their business

- Easy KYC for payment gateways: Platforms like Razorpay, Paytm or Stripe use NIC code to verify business type, which makes the onboarding process smoother.

Example 2:

A home bakery owner

Business name: Sweet Crumbs Home Bakery

Business activity: baking cakes, pastries, cookies and other baked items

Correct NIC code: 1071, manufacture of bakery products

Sweet Crumbs Home Bakery is a small, home-based business where the owner bakes cakes, cookies, and snacks. The business is involved in making food products, which include baked items. NIC code 1071 is the best fit. This code represents “Manufacture of bakery products”

Why is this NIC code important?

- MSME/Udyam registration: NIC code for MSME registration, which can offer benefits like subsidies, easier loans, and reduced interest rates.

- Food permits & approvals: Authorities can quickly understand that the business deals with food, making it easier to apply for FSSAI registration and other bakery-related licenses.

- Bank accounts & GST: Banks and tax departments can clearly identify a business as a food manufacturing unit, helping with GST registration and opening a current account.

Conclusion:

Choosing the right NIC (National Industrial Classification Code) code may seem like a small step, but it plays a big role in how your business is identified, registered and supported in India. The correct code helps the government understand your activity, making the smooth processing of registrations, such as GST, easier. This, in turn, facilitates qualification for schemes, loans, licenses, and compliance checks.

By identifying your main activity, using the help of the NIC code finder tool, selecting the right NIC code that matches your business correctly and keeping your code updated, you can avoid common mistakes and keep your business records accurate. Whether you’re running a tech company, a home bakery, a retail shop, or any other venture, code acts as your business’s official identity across multiple systems. The correct NIC code is a key step in building a compliant, professional and future-ready business. With the right code, you set a strong foundation for growth, recognition and long-term success.

No comments yet